Southeast Asia's e-commerce growth rate ranks first in the world, with sellers rushing in

1. Leading the world

As the first stop for most Chinese companies to go global, Southeast Asia is still full of imagination.

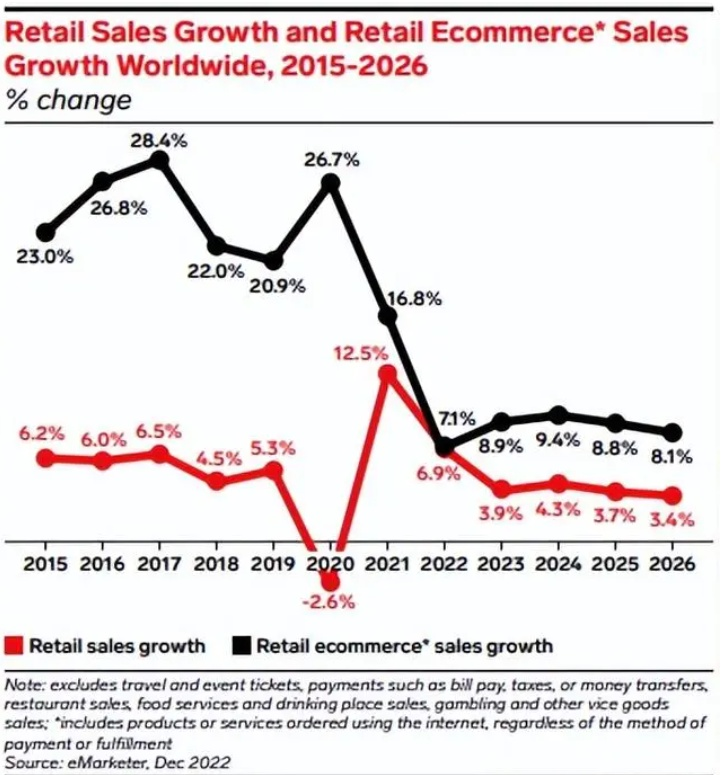

Recently, eMarketer released the latest report on the global electronic retail market in 2023, predicting that global electronic retail sales will reach $60000 billion in 2023 and exceed $70000 billion in 2025. Southeast Asia, as the region with the fastest growth rate of e-commerce, still deserves our attention.

According to the report, since COVID-19 triggered the explosive growth of e-commerce in 2020, the growth of global e-commerce has slowed sharply, from 26.7% in 20 years and 16.8% in 21 years to 8.9%.

However, according to eMarketer's prediction, the growth rate of retail e-commerce sales in Southeast Asia in 2023 will far exceed the average growth rate of 8.9% for global e-commerce.

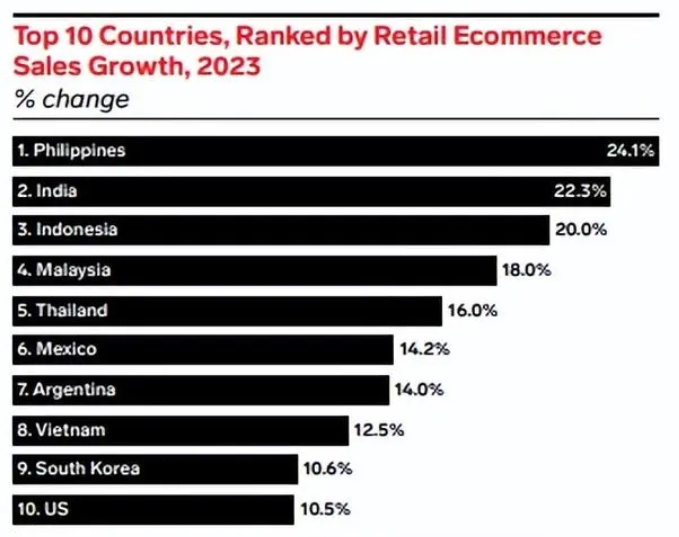

According to the report, the Philippines will rank first with a growth rate of 24.1%, followed by India, Indonesia, Malaysia, Thailand, Mexico, Argentina, Vietnam, South Korea, and the United States.

In terms of the development of the digital economy in various countries, it is expected that Thailand, Indonesia, Vietnam, Malaysia, the Philippines, and Singapore will have comprehensive and sustained growth, with the GMV growth rate of the digital economy in Vietnam and the Philippines being higher than other countries in Southeast Asia from 2022 to 2025. Therefore, it can be inferred that the GMV scale of the digital economy in Vietnam and the Philippines is expected to rank among the top three in Southeast Asia by 2030.

2. Unlimited potential

As the region with the largest growth rate, the new e-commerce model, taking live streaming e-commerce as an example, has also achieved good development in Southeast Asia.

According to a survey report released by Southeast Asian logistics giant Ninja Van, although live streaming sales are still a relatively "fresh" tool in the region, nearly one-third of the surveyed sellers have tried live streaming.

It is worth mentioning that 90% of the surveyed sellers prefer to live on their own, while only 10% of the surveyed sellers choose to live on online celebrity, which is related to the cultural environment in Southeast Asia, where residents have a strong desire to express themselves and like to release videos or even display themselves online.

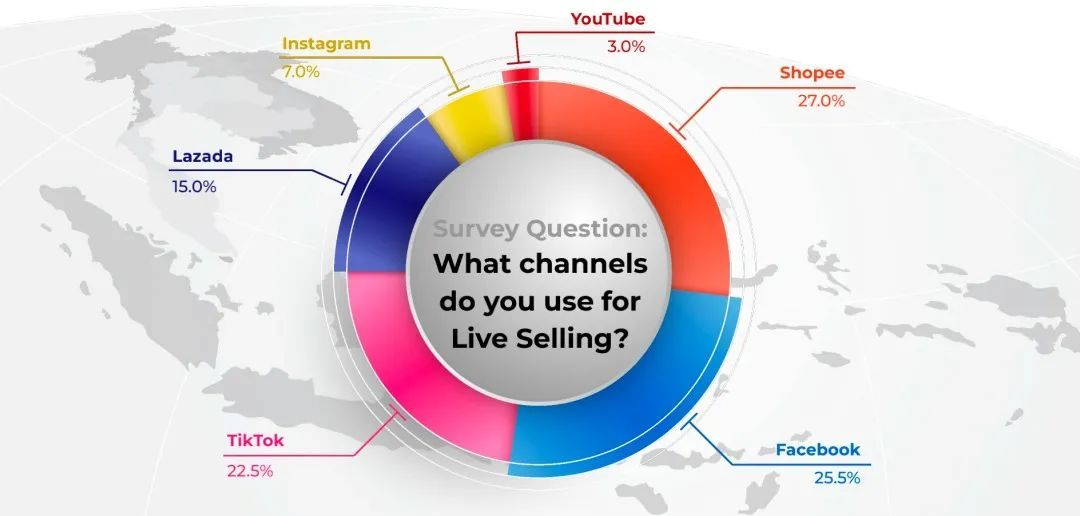

From the perspective of the live streaming sales platform most commonly used by sellers, Shopee ranks first, followed closely by Facebook and TikTok.

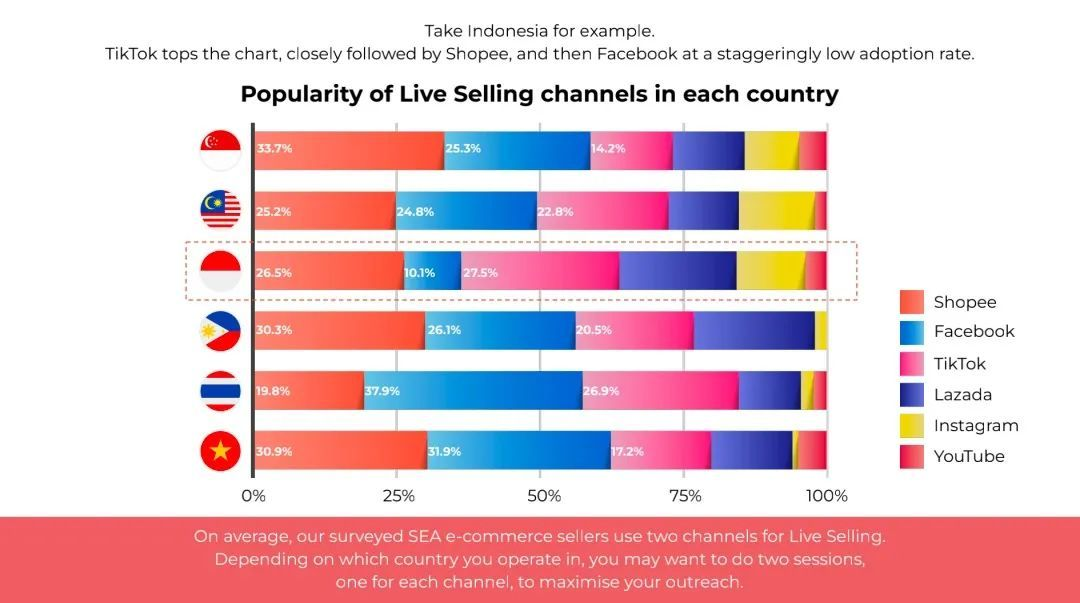

However, the platforms preferred by sellers vary from country to country. For example, Shopee is the preferred choice for sellers in Singapore, Malaysia, and the Philippines, with Facebook and TikTok ranking second and third; In the Indonesian market, TikTok is more popular with sellers, with Shopee and Facebook ranking second and third..

According to data released by Omise, an online payment gateway in Thailand, in June last year, the annual growth rate of GMV in the live streaming e-commerce industry in Southeast Asia reached 306%, and the order volume increased by 115% in the year. It also predicts that the market size of live streaming e-commerce in Southeast Asia will reach $19 billion in 2023.

In general, despite the slowdown in the global e-commerce market, Southeast Asia still has great development potential, and has always shown explosive growth in a spurt. For cross-border sellers, with the stability of the overall environment, the cross-border e-commerce market will gradually advance in the future. Sellers should adjust their mindset in a timely manner, greet new markets and opportunities with the best posture, and seize the opportunity to seek more growth points.